The Ultimate Forex Trading Course for Learning Money Markets

The Ultimate Forex Trading Course for Learning Money Markets

Blog Article

The Money Exchange Market: Insights and Devices for Effective Trading

The money exchange market, or Foreign exchange, stands as a critical field for investors seeking to utilize on international money variations. By comprehending financial indications and geopolitical impacts, traders can place themselves advantageously within this huge market. What crucial factors must investors take into consideration to preserve an affordable side?

Understanding Foreign Exchange Basics

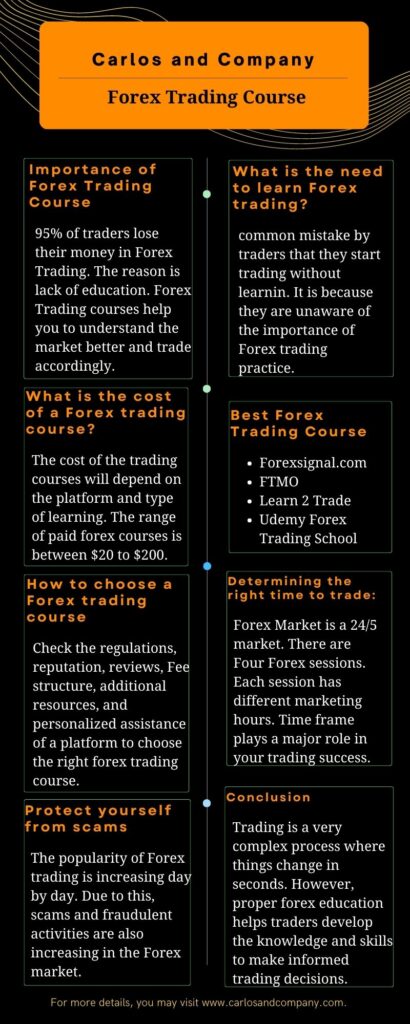

Foreign exchange, brief for fx, is the worldwide marketplace where currencies are traded, and its importance expands beyond basic currency conversion. This decentralized market operates 24 hours a day, five days a week, and is vital in helping with global trade and investment (forex trading course). Unlike standard stock market, foreign exchange operates via a network of banks, brokers, and banks, ensuring a constant circulation of currency purchases across various time zones

Recognizing foreign exchange essentials involves grasping crucial concepts such as currency pairs, currency exchange rate, and market volatility. Currency sets, like EUR/USD or GBP/JPY, signify the loved one worth of one money versus an additional. The very first currency in both is the base money, while the 2nd is the quote money. Exchange rates suggest exactly how much of the quote currency is required to purchase one system of the base money, and these rates change based on supply and need dynamics.

Market volatility in foreign exchange is affected by economic signs, geopolitical events, and market view. Traders utilize technical and basic evaluation to anticipate market activities and make informed trading choices (forex trading course). By understanding these essential concepts, individuals can navigate the intricacies of the forex market better

Trick Market Athletes

Who are the principals forming the dynamics of the foreign exchange market? At the center are main financial institutions, which hold substantial guide over money activities via financial plan choices, passion prices, and treatment approaches. Their activities can bring about significant market changes, influencing currency supply and demand. Alongside reserve banks, commercial financial institutions and economic establishments play a crucial duty by promoting foreign exchange deals for clients, taking part in speculative trading, and supplying liquidity to the marketplace.

Bush funds and financial investment managers are also influential, often implementing big forex trades focused on optimizing returns for financiers. Their techniques can drive significant cost movements, specifically in minutes of high market volatility. International companies are essential participants as well, taking part in foreign exchange deals to hedge against money threat intrinsic in worldwide operations, consequently affecting the supply and need dynamics.

Retail traders, though smaller sized in purchase size, collectively add to market liquidity and diversity. Innovations in technology and online trading platforms have democratized gain access to, permitting specific investors to participate actively in forex markets. Brokers and market makers guarantee the smooth operation of trades by offering platforms and services that help with market access and pricing transparency.

Studying Market Trends

In the ever-evolving landscape of the currency exchange market, analyzing market trends is essential more for understanding and predicting currency activities. Investors utilize both essential and technical analysis to anticipate future rate adjustments. Essential analysis involves assessing economic indicators such as interest prices, rising cost of living, and political events that may affect nationwide economic situations. This macroeconomic technique assists traders prepare for just how these aspects will affect money values.

On the other hand, technical evaluation focuses on historic rate information and market patterns to predict future activities. Traders usually utilize charts, relocating standards, and various other technical indicators to determine trends and possible entry or leave points. Identifying patterns such as head and shoulders, double tops, or triangles go to website can supply insights right into market sentiment and possible future actions.

Additionally, using analytical devices like the Relative Stamina Index (RSI), Relocating Typical Merging Divergence (MACD), and Bollinger Bands improves the capacity to spot market fads. These tools step energy, volatility, and price direction, supplying traders a detailed sight of market dynamics.

Effectively analyzing market patterns needs a mix of these techniques, enabling investors to make enlightened decisions and adapt to the complicated, rapidly-changing setting of the money exchange market.

Risk Administration Methods

Reliable risk management methods are crucial for navigating the uncertainties intrinsic in the money exchange market. This vibrant setting, identified by volatility and rapid fluctuations, demands a robust method to secure financial investments and decrease prospective losses. One fundamental method is diversity, which entails spreading out investments throughout various money sets to lower exposure to any solitary money's adverse movements.

In addition, setting stop-loss orders is a vital method that enables traders to predefine the point at which they will leave a shedding profession, consequently limiting losses. These orders are especially helpful in stopping emotional decision-making during volatile market problems. Moreover, preserving a suitable level of leverage is critical. Too much take advantage of can enhance losses, turning tiny market relocates into substantial monetary problems.

Vital Trading Devices

Effective money trading pivots not only on approaches however additionally on the efficient use necessary trading devices. These tools are crucial for evaluating market information, executing professions, and taking care of portfolios effectively. Amongst the most websites crucial devices are trading platforms, which supply real-time information, charting capabilities, and seamless profession implementation. Platforms like MetaTrader 4 and 5 are prominent as a result of their robust features and easy to use user interfaces.

Another vital device is financial schedules, which track vital financial occasions that can significantly impact currency costs. By staying notified regarding upcoming statements, investors can prepare for market activities and readjust their approaches accordingly. Technical evaluation devices, such as indications and oscillators, aid investors recognize fads, assistance, and resistance degrees, helping in even more educated decision-making.

Verdict

The money exchange market necessitates a thorough understanding of its dynamics, requiring investors to integrate basic and technical evaluations for efficient decision-making. Identifying fads through devices such as moving standards and RSI, alongside remaining informed using economic schedules, enhances trading precision. Implementing threat management approaches, consisting of stop-loss orders and diversification, is critical for protecting financial investments. Mastery of these parts offers a strong structure for navigating the intricacies of Forex trading and accomplishing lasting success in this unpredictable market.

Report this page